Comparing Startup Equity Compensation Flavors: ISOs, NSOs, and RSUs

If you haven’t subscribed yet, you can get thoughts and musings about personal finance and whatever else I find interesting straight to your inbox by clicking here:

Equity compensation can come in a number of different flavors, although it’s rare for companies to spell out the precise differences between them (probably partially because they don’t want their statements to be construed as financial advice). The differences matter a lot in terms of taxation and liquidity, so it’s helpful to understand the differences between ISOs, NSOs, and RSUs.

Incentive Stock Options (ISOs)

ISOs are the most common type of equity you’ll see in an earlier-stage startup, where earlier-stage is defined as 500 employees or less, and under $1B in valuation (hopefully obvious that this isn’t a hard-and-fast rule).

ISOs are true stock options, in that they represent the right to, or having the option to purchase a share of stock in a company at a set price (the strike price). The implication there is that you don’t actually own your stock until you’ve notified the company of your intent to exercise your shares, and paid the exercise costs (strike price times the number of shares). Once you’ve done that, the company will process the request, and you’ll be issued a stock certificate (these used to be paper certificates that would be mailed to you, but most organizations use digital certificates nowadays).

ISOs are special for a handful of reasons:

They’re only for employees. You can’t get ISOs as an outside contractor or a board member. You’ll need to sign an offer letter to get these babies.

They have advantageous tax treatment compared to other types of equity compensation. ISOs are the most tax-advantaged equity compensation available. This is because the taxes on gains are generally deferred until you actually sell the exercised stock. There are three crucial prices to keep in mind when dealing with ISOs: strike price, fair market value, and sale price.

The most important bit is that when you exercise ISOs, you might owe taxes, but only if the gains would force you into paying AMT. If you exercise a lot of ISOs, and those ISOs are highly-appreciated (say if you joined the company at the A-round, and your company is about to IPO), you’re likely to pay AMT. However, if the stock is only mildly appreciated, you might not owe any taxes at this time at all.

This is also one of the reasons that early exercising can be beneficial. You take on a lot of financial risk when you early exercise, because you’re essentially making a bet that the stock will be worth a lot more in the future, but it’s best to early exercise before a funding round, to ensure that you don’t get impacted by the increase in fair market value that a funding round will generate (assuming the funding round is a good thing, and not a reduction in company valuation). For example, if you just joined a company, and you early exercise a year’s worth of vested equity, and no funding rounds have happened between your start date and now, the strike price and fair market value are likely to be the same number, and so you have $0 in AMT exposure.

For employees at companies doing really well, it’s also important to know that there is a $100,000 limit on ISO treatment in a given fiscal year. The really short answer for what this means is that if you exercise stock that is worth more than $100,000 in a year (its value based on FMV, not strike price), the amount above $100,000 will be treated as NSOs (and you’ll likely pay a lot more in taxes). I’ll come back to this in the NSO section to re-clarify this bit.

Because of the advantageous ISO tax treatment, the overall upfront cost of exercising an ISO is pretty low (relative to other forms of equity compensation), and so it becomes a lot more feasible for employees to buy-and-hold stock. The advantage to holding onto the stock for the longer term is that long-term capital gains (if you hold the stock for a year or more) are generally much cheaper than short-term income tax (if you hold the stock for less than a year, like if you wait to exercise options till after an IPO, and then immediately exercise, then sell the exercised stock). Federally, capital gains tax will typically land at 15-20%, whereas income tax brackets are likely to be more in the 32-35% range (obviously, entirely dependent upon personal income situations).

ISO treatment expires 90 days after you leave the company. By law, if you leave the company (quit, are fired, laid-off, whatever), you have 90 days to exercise any vested ISOs. After those 90 days, one of two things will happen:

You forfeit the options, and they go back into the pool of options that the company can give out to future/current employees.

The company gives you an extension (this could be pre-negotiated) to exercise your options, but the options are treated as NSOs, not ISOs, after 90 days.

NSOs have very different tax treatment, so this distinction is critical to understand.

Non-Qualified Stock Options (NSOs or NQSOs)

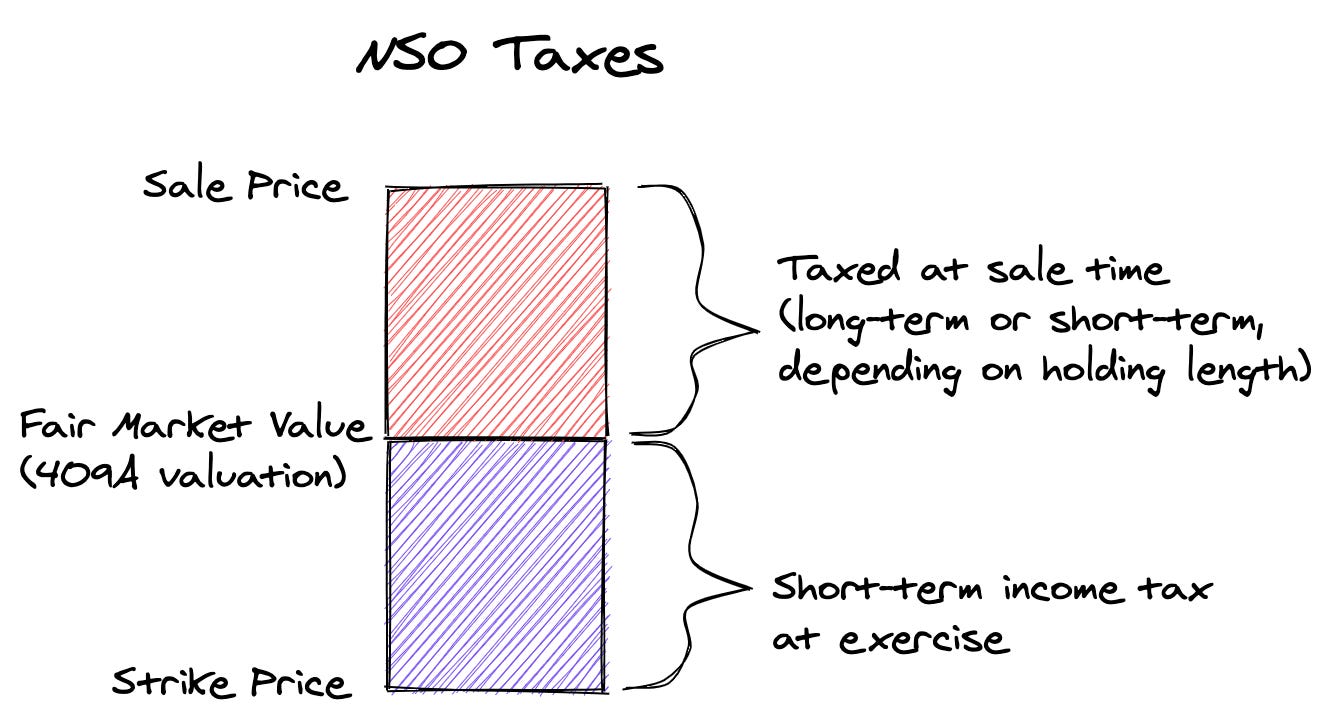

Essentially, any stock option that isn’t an ISO is an NSO. Mechanically, NSOs work basically the same way as an ISO. There’s a strike price, a fair market value, and a sale price. However, the tax treatment on NSOs is pretty brutal comparatively. Whereas with ISOs, you only pay tax at exercise time if you would owe AMT, with NSOs you pay income tax at exercise time on whatever your paper gains are.

If you think through the implications of that short-term income tax at exercise, NSOs become a little bit horrifying. If you join a company early on, have NSOs, and exercise them after several funding rounds, but the company isn’t public, you’re about to be in a world of hurt with the IRS. If your strike price is $1, and the FMV is $5, and you exercise 10,000 shares, you pay $10,000 to the company to exercise, and then the IRS wants income tax on $40,000 in gains, probably somewhere in the neighborhood of an additional $14,000. Oof.

This is also important when we get back to that $100,000 rule I mentioned with ISOs. If we consider a scenario where an employee has a strike of $1, FMV of $5, and exercises 25,000 shares, you’ll end up in this situation:

Due to the $100,000 limit on ISOs in a year, exercising 25,000 options would produce $100K of gains with the first 20K options, and the final 5K in options would be taxed as NSOs, which means paying income tax on $20,000 in gains ($25K value minus the cost basis of $5K). That equates to $7,000 or so in guaranteed income tax, on top of any AMT exposure you might have as a result of the ISO exercise-and-hold.

Understanding this difference in taxation is also important if your company gives you an unusually long option expiry. For example, I worked at a company a couple jobs ago that offered a 10-year option expiry. I could leave the company, but not have to exercise for another 9 years or so. That’s an incredibly valuable benefit, because it dramatically de-risks my potential gains. Either the company has a liquidity event in 9 years (which, according to Crunchbase, is conveniently the amount of time that SaaS companies typically take to exit), or within 9 years, I’ll have a much better picture about the likelihood of a successful outcome for the company. However, the ISO options that I held convert, after 90 days, to NSOs, and so my tax treatment changes. Whenever I go to exercise those options (assuming I do, ever), I’ll owe a sizable amount of income tax, so I’m unlikely to exercise until I know I can sell them, or I’m forced to exercise due to an acquisition or other change in control.

Restricted Stock Units (RSUs)

Most companies start with issuing ISOs to employees, and switch later on to RSUs. There’s a number of reasons why this happens, and Carta has a pretty helpful article on when and why this happens. RSUs are a pretty different beast from options, because a) there is no exercise price (you just get RSUs when they vest), and b) RSUs sometimes have more complex vesting and ownership rules than options. Unsurprisingly, this also comes with drastically different tax treatment.

Oftentimes when companies get to the later stages of being a private company, two things happen:

The FMV of the company increases fairly dramatically, and consequently, the strike price of new options issued starts to rise dramatically.

The gap between the strike price on options and the preferred price (what investors are paying for their stock) tends to get narrower

Because the gap between strike prices and preferred prices starts closing, the inherent value of the options becomes smaller. You can imagine if you were issued 1,000 options with a $1 strike, but the preferred price is $5, that you’re effectively receiving a grant of options worth $4,000. Over time, that gap closes, and maybe the strike is $10, but the preferred price is only $12, making a lot of 1,000 options only worth $2,000. In the first case, you’d have to pay $1,000 to get access to the $4,000 in value, but in the second case you’d have to shell out $10,000 in order to make $12,000. That rising strike price makes the value less accessible to employees that don’t have a giant wad of cash under their mattress.

Enter RSUs. RSUs change the equation, in that you don’t receive an option to purchase stock, or even stock, in reality. You get this thing. This...unit. It represents a share of stock, and when it vests, you do, indeed, get a share of stock. At the low, low price of free ninety-nine. In issuing RSUs instead of options, companies achieve two goals:

Enable new employees to get value from equity: When the RSUs vest, employees get stock that is worth some non-zero amount, without having to pay anything. Happy employees.

Better control over dilution: Because the RSUs aren’t really stock, they don’t dilute the stock pool immediately (though they do as they vest). This means that dilution is a steadier drip over time, rather than something that comes in big waves as new option pools are issued. This helps to keep the stock price higher over a longer timeline.

What really sucks about RSUs is that it’s a lot harder to manage them in a tax-efficient manner. Because you’re effectively vesting stock without having to pay for it, every month, the IRS says “Ah, you’ve made money! I would like my cut, please.” Whatever that stock is worth, the IRS says is income.

If you work for a public company, where your stock is liquid, many folks just turn around and sell the stock immediately to cover the income tax, and the RSUs effectively become a bonus, rather than really a long-term equity growth opportunity. Now, it is the case that you can choose to pay the taxes, and hold the stock to get long-term gains on upside down the road, but it’s an expensive proposition.

If you work for a private company, this probably sounds terrifying, because if the IRS thinks you just made a bunch of money, but you have no way to sell your stock to get liquidity to pay taxes, you’re probably feeling like you’re up a creek, without a paddle. And you would be. Except private companies are clever, and often utilize multiple triggers for vesting. There’s always a time-based component (four years, one-year cliff, usually), but what also often exists is a liquidity vesting trigger. If the stock isn’t liquid, the company technically doesn’t hand over stock when the RSUs meet the time-based vest. They wait for the liquidity event to dump all of the stock on you, and thus all of the taxable income.

In some ways, holding back your income, so that you don’t owe taxes, is a really nice thing for the company to do, but it also can create the dreaded “golden handcuffs” scenario. Because employees don’t technically own the shares, if they leave the company before the liquidity event, they may forfeit any vested RSUs. Big bummer. It’s a good reason to make sure you’re ready to strap in for the IPO ride if you’re headed to a large, late-stage private company.

Restricted Stock

As a final extra type of equity worth mentioning, the earliest employees, and perhaps some particularly critical executives, will receive restricted stock. Restricted stock and RSUs are decidedly not the same thing.

Restricted stock is usually given as an upfront grant, or the employee is given the option to purchase a grant of restricted stock for a nominal price (founders typically pay around $.0001 per share, so for companies that are founded with 10M shares, which is pretty typical, two co-founders would each put in around $500 to purchase their stock upfront). These shares then go through a reverse vest. Instead of, on a monthly basis, vesting the option to purchase shares of stock, the company, on a monthly basis, loses the right to repurchase the shares from the employee, should they part ways with the company.

Other than that, this is standard equity, and oftentimes, because restricted stock is usually the equity of choice at the earliest stages, qualifies for qualified small business stock treatment (QSBS). Stock that qualifies as QSBS is federal tax-free, so this is a huge windfall for early founders, early employees, and early investors. There are a number of checks and criteria that stock has to pass to get the QSBS treatment, so it requires a little legwork to benefit from this, and if you want to know more, you can check out my post on the subject.

A quick note on early exercise

I’ve made a couple mentions of early exercising, and in the case of restricted stock, typically, you are effectively early exercising all of your equity package. While early exercise is a very powerful tax strategy, it’s easy to get wrong. Early exercise allows you to purchase stock or exercise options before they have actually vested, and essentially converts the purchased stock into restricted stock with a reverse vest as described in the previous section. It gets the long-term capital gains timer (and QSBS timer) going earlier, and can enable you to minimize the delta between the strike price and FMV (potentially ensuring that there are no taxable gains at exercise). However, you must file an 83(b) form with the IRS in order to get the benefits. The 83(b) has to be filed within 30 days of the exercise, so expediency matters. Don’t forget to do this, because if you do, you will be very unhappy later.

Make better decisions by knowing what you own

Because every type of equity compensation has its own quirks and nuances, it’s important to educate yourself on what you own and how it works. There’s a good chance if you’ve worked at more than one startup, you’ve encountered different variations on these types of equity, even if you weren’t aware of it at the time. With this knowledge, hopefully you can make more informed decisions about when to exercise, when to sell, and make tax time a less stressful experience.

This is helpful but I sure wish you did an article on how to manage both NSOs and RSUs simultaneously as it relates to tax.